There are a lot of reasons why to invest in Thailand, especially in Phuket, but these 3 stand out:

Why invest in 2024 in Phuket?

The ongoing development of the second phase of the “Andaman International Airport” in Phang Nga is anticipated to reach completion by 2031.

This advancement is not only set to enhance tourism in the area but is also likely to drive a continuous increase in land prices.

As trailblazers in real estate development within Phang Nga, we take pride in our role and extend an invitation for you to be part of this promising venture. Seize the opportunity for a sound investment – act now!

Freehold vs Leasehold explained

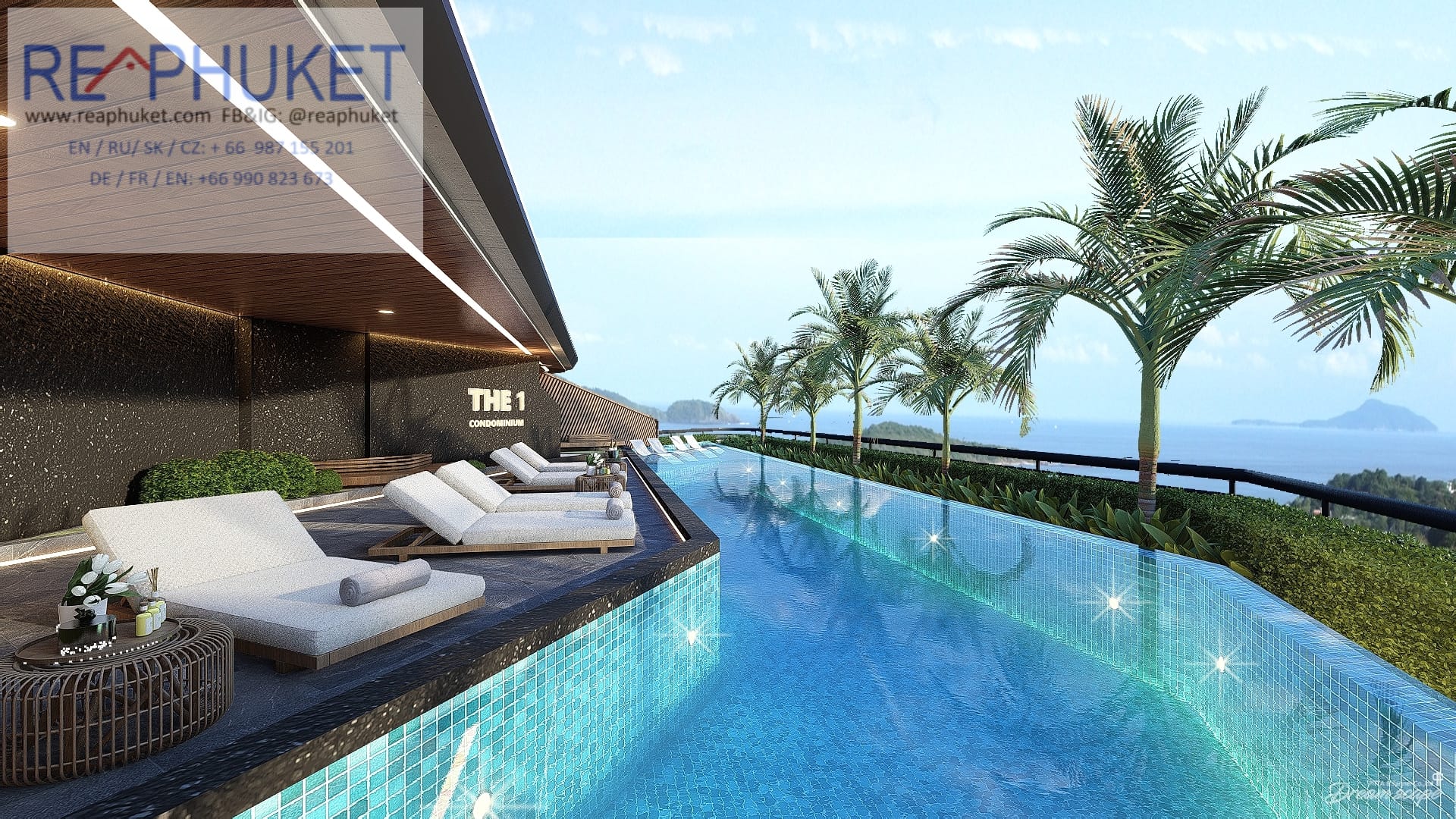

Phuket, renowned for its stunning beaches, rich culture, and year-round warm, sunny days, stands as a perennial favorite among global tourists. Simultaneously, it has secured its place as a real estate hotspot, attracting foreigners eager to invest in Thai properties. From sea-view condominiums in Patong to waterfront penthouses in Kamala, contemporary apartments on Karon Hill to luxurious villas alongside Bangtao Beach, Phuket offers a diverse range of dream houses.

Ownership and Investment

Selecting the right property in Phuket involves critical considerations, with ownership being paramount. Foreigners face a challenge due to Thailand’s Land Code prohibiting land ownership. While the Condominium Act allows freehold units in condominium projects, leasing is a viable option. Foreigners can effectively utilize land through a leasehold tenure, allowing ownership of structures on that land.

Presently, foreign freehold and leasehold ownership emerge as the predominant and legally accepted methods for property ownership in Phuket. Each option presents distinct advantages and disadvantages, demanding careful consideration based on individual property needs. Let’s explore the nuances of both.

Foreign Freehold

According to the Thai Condominium Act, foreigners can own units within the foreign freehold ownership quota, limited to 49% of the total unit floor area in a condominium. The remaining 51% must be owned by Thai nationals.

Pros and Cons of Foreign Freehold

Pros:

1. Ownership of condominium units in the individual’s name.

2. Desirability in the resale market.

3. No time limit on ownership.

4. Ability to sell, mortgage, or pass on the unit.

5. Low property tax burden over time.

6. Voting rights at general meetings.

Cons:

1. Higher initial purchase costs.

2. Increased transfer fees and taxes compared to leasehold.

Leasehold

Leasehold tenure grants the right to occupy a building or land for a predetermined time, usually 30 years for foreign buyers in Thailand, with optional renewals. Foreign buyers are recognized by the Land Department for their lease rights.

Pros and Cons of Leasehold

Pros:

1. Diverse property options – villas, houses, or townhouses.

2. Reduced responsibility for property maintenance.

3. Option not to renew after lease expiration.

4. Lower costs for registration and purchase.

Cons:

1. Limited duration of property lease.

2. Annual rental tax and registration fee.

3. No voting rights at general meetings.

Protected Leasehold

Developers often offer a “Protected Leasehold,” providing a foreign buyer shares in a Thai limited company owning the property. This arrangement aims to secure lease renewals for the additional 30-year terms.

Protected Leasehold safeguards the tenant in scenarios involving lease termination, property return after 30 years, property transfer to heirs, or any restructuring of the investment.

For inquiries or a comprehensive consultation please contact us.